renounce green card exit tax

In brief summary the HEART Act Exit Tax affects US citizens and permanent residents or Green Card holders who are planning to renounce their US citizenship or give back their Green Card. Exit Tax on the Roth IRA for Covered Expatriates.

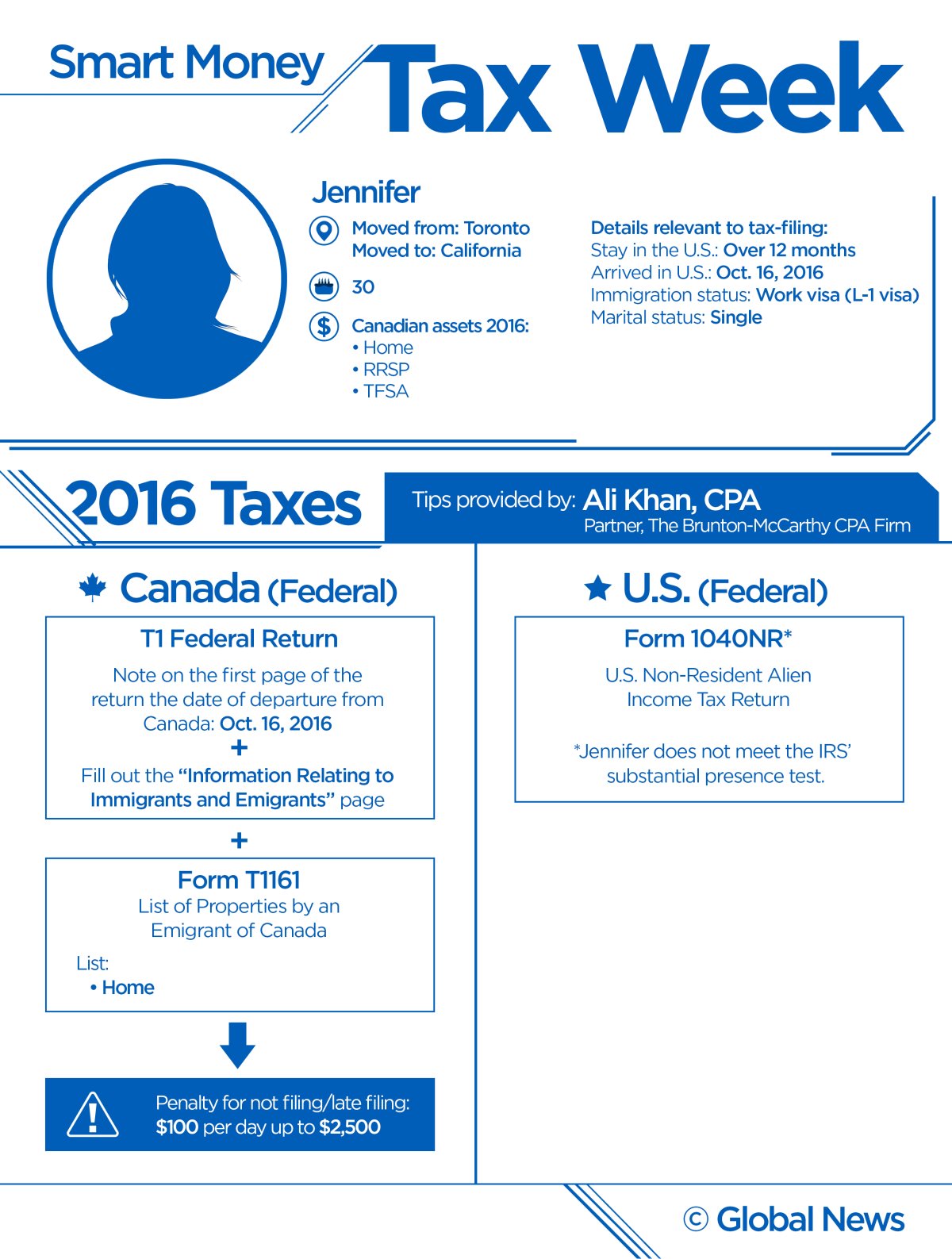

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

If any of the following two criteria apply to you you may face an exit tax bill.

. Tax Guide for Aliens. If the expatriate is under 59 12 then the earnings are taxable the exceptions listed above are usually inapplicable to expatriation. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

Individuals who renounced their US. If 59 12 or over the Covered Expatriates meet the first prong and is part way in the clear. Citizens and Green Card Holders Residing in Canada and Abroad Renounce US.

For more detailed information refer to Expatriation Tax in Publication 519 US. This event causes the long-term resident to be. But the rules are not limited to US.

In the context of us personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their us citizenship or green card. This event causes the long-term resident to be an expatriate subject to the exit tax rules. Green Card Exit Tax 8 Years The general proposition is that when a US.

Once long-term resident status is attained there are two ways that a green card holder can trigger the exit tax rules. Firstly why is this even a thing. Advance planning is essential to avoid any unpleasant consequences.

Citizenship Green Card Abandonment FATCA and CRS Tax Residency Retirement Planning For Americans Abroad Second Citizenship Menu Skip to content. Citizen renounces citizenship and relinquishes their US. Once long-term resident status is attained there are two ways that a green card holder can trigger the exit tax rules.

Roth IRA Under 59 ½ Years Old. Attach your initial Form 8854 to your income tax return Form 1040 1040-SR or 1040-NR for the year that includes your expatriation date and file your return by the due date of your tax return including extensions. Renouncing citizenship or giving up a green card can be expensive when it comes to the IRS.

Or you may also attempt to keep your annual net income smaller than the threshold and avoid staying in the United States for a long time falling under the eight years out of fifteen years residency rule. Status they are subject to the expatriation and exit tax rules. To avoid exit tax when deciding to have a voluntary renunciation you may consider distributing your assets to your spouse.

The Exit Tax The exit tax applies both to covered expatriates who relinquish citizenship and to green card holders who relinquish their green cards including those who abandon their green cards or take a treaty position if they held their green card for a period of 8 years during the last 15 years. But the rules are not limited to US. First the green card holder can voluntarily abandon the visa status or the government might forcibly cancel the visa.

If you are renouncing your US citizenship the IRS will most likely require you to consolidate your tax affairs via the exit tax process. First the green card holder can voluntarily abandon the visa status or the government may forcibly cancel the visa. First the green card holder can voluntarily abandon the visa status or the government might forcibly cancel the visa.

The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. Citizenship or long-term residents that terminated their US residency for tax purposes on or before June 3 2004 must file an initial Form 8854 Initial and Annual Expatriation Information Statement. This event causes the long-term resident to be an expatriate subject to.

Here is the overall impact on expatriation. Also send a copy of your Form 8854 marked Copy to. If youre looking to renounce your US citizenship or green card and expatriating you should keep in the mind the tax consequences of doing so both in terms of tax cost and reporting obligations.

However most of our readers are immigrants and it is worth noting that individuals who acquired US citizenship while holding citizenship from a different country by birth may be outside the. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. The tax implications of renouncing US citizenship or green cards.

Heres how the feds compute the Exit Tax.

Benefits Of Renouncing Us Citizenship And Retiring With Ease

The Definition Of A U S Tax Resident Not As Simple As You Think

Leaving Canada Permanently Here S What To Know About Departure Tax

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Canada Pr Get Canada Permanent Resident Visa From India Y Axis

More People Are Renouncing American Citizenship Internationalwealth Info

Benefits Of Renouncing Us Citizenship And Retiring With Ease

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

The Definition Of A U S Tax Resident Not As Simple As You Think

Benefits Of Renouncing Us Citizenship And Retiring With Ease

Canada Pr Get Canada Permanent Resident Visa From India Y Axis

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Benefits Of Renouncing Us Citizenship And Retiring With Ease

/GettyImages-511101404-d5999c51fbd444cdba285b39a7db30d3.jpg)