how to get help with delinquent property taxes

Options may be payment plans low interest loans as a form of financial aid exemptions and more. If you owe delinquent property taxes youll get hit with an additional 2 penalty for every month you havent paid.

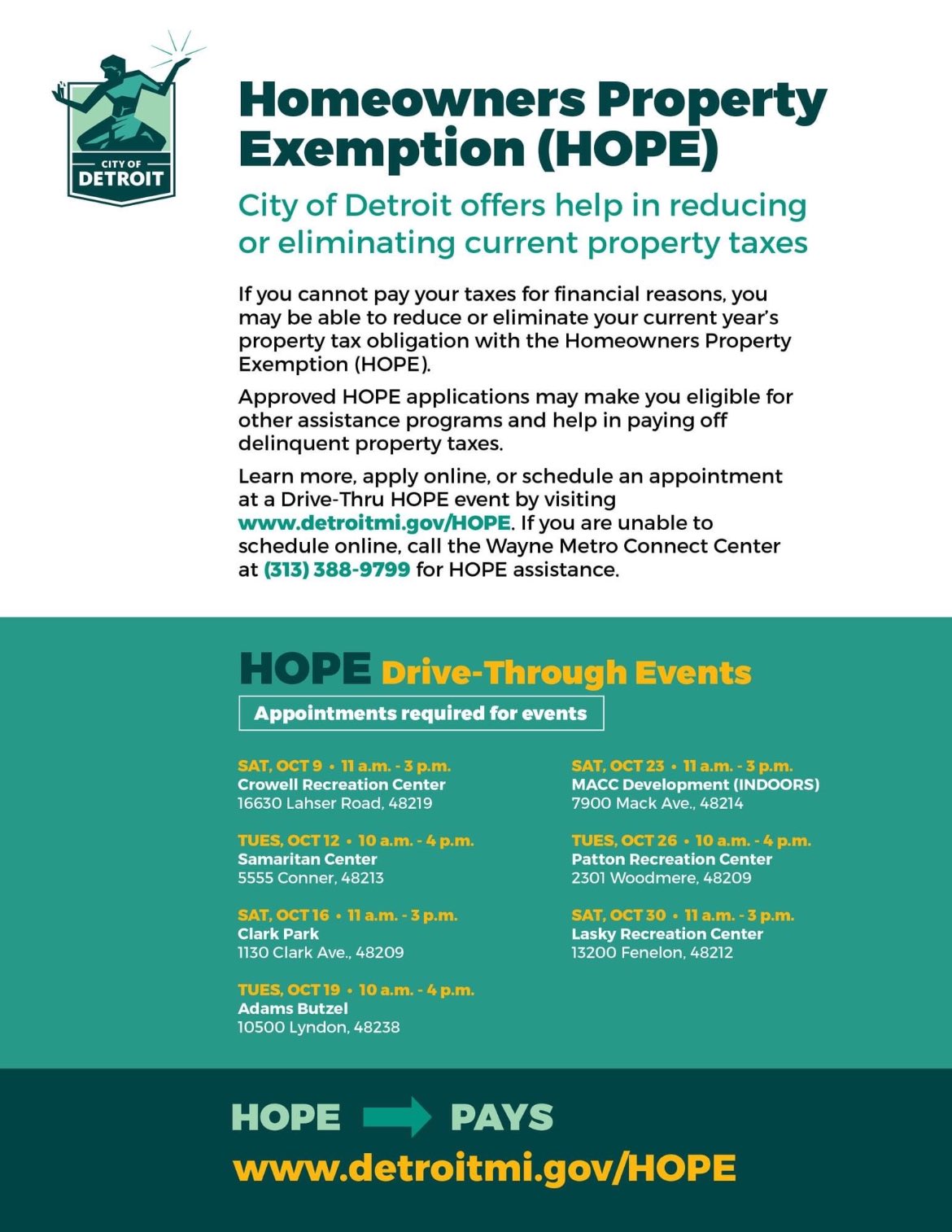

Janee Ayers On Twitter The Final Two Homeowners Property Exemption Hope Drive Thru Events Are Today At Patton Rec Center 10 4pm And On Saturday From 11 3pm Lasky Rec Center Approved Hope Applications May

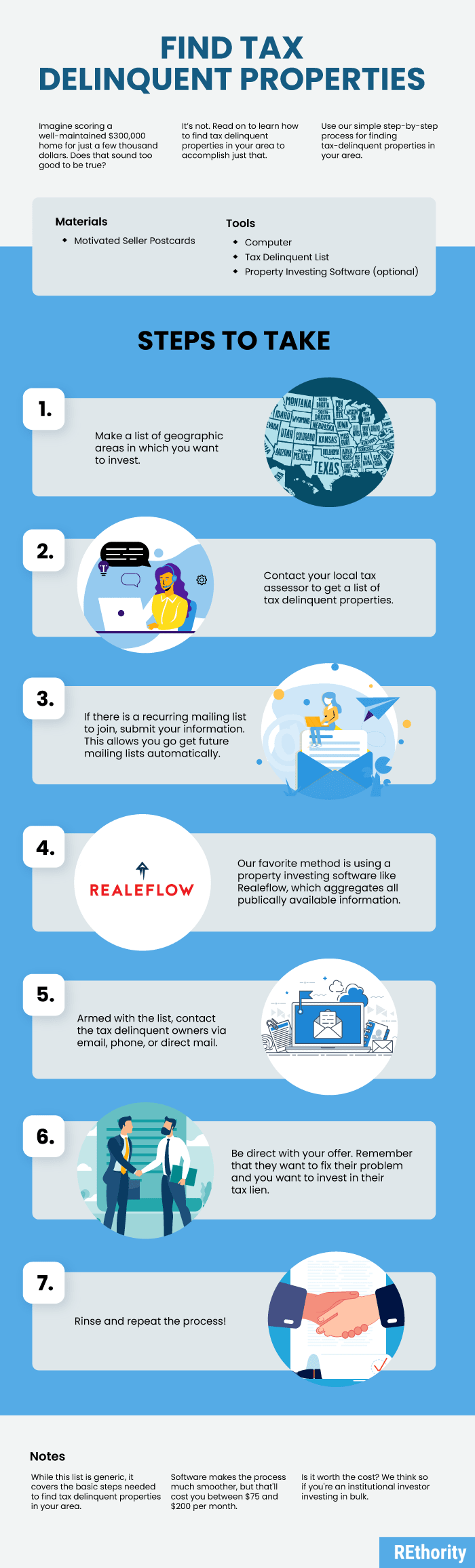

Gaining access to a list of tax delinquent homeowners is a critical step but its the first step of many.

. Senior homeowners experiencing hardship can fully or partially defer payment of their delinquent and future property taxes for either a fixed or indefinite period of time. To help property owners manage their taxes and regulate debts DoNotPay created a practical feature. On top of those ongoing penalties theres a 20 collection fee thatll slam you.

Homeowners that are unable to pay their property tax bill risk losing their property. Ask for a Payment Plan. Here is how it works.

Find how to get help with delinquent property taxes including information on installment. When Your Property Taxes Are Delinquent Get Help From Tax Ease If your property taxes are delinquent start by completing our simple online loan application with no credit check. You are given 10.

Know your tax responsibilities. If the property owner fails to pay delinquent taxes within two years from the date of delinquency the tax certificate holder investor may file a tax deed application. Apply for a payment plan through the property tax office.

How to Get Help Paying Your Property Taxes When You Are Behind. Some counties will and others charge a. Once your price quote is processed it will be emailed to you.

The Tax Office accepts full and partial payment of property taxes online. Direct Mail To Tax Delinquent Property Owners. Follow these simple reminders below.

You can take many steps to avoid having delinquent taxes. Essentially if the property tax bill goes unpaid the county can sell a tax lien certificate to. You can choose to pay.

The first thing to do is contact your city or the county treasurer to see if they will give you the list for free. June 15 2022. So how do You Get the Tax Delinquent List.

The county treasurer and any tax collectors who do not return unpaid taxes to the county treasurer provide data on delinquent homeowners to the county real property tax RPT. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. File your tax return electronically to lessen.

A tax deed application may. You may request a price quote for state-held tax delinquent property by submitting an electronic application. The California Mortgage Relief Program has expanded eligibility requirements to give California homeowners a fresh start in their homes if.

Open DoNotPay in a web browser Choose the Reduce Property.

Reimagine Delinquent Property Tax Enforcement Center For Community Progress

Help For Homeowners With Delinquent Property Taxes Oc Treasurer Tax Collector

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax Assistance How To Find Property Tax Help In Texas Tax Ease

Delinquent Property Tax Enforcement Center For Community Progress

Delinquent Property Taxes Lafourche Parish Sheriff S Office

How To Check For Property Back Taxes And Liens For Free In 2020 Compass Land Usa

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Delinquent Property Taxes May Lead To Foreclosure Home Tax Solutions

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

700k Available For Miami Valley Residents Behind On Property Taxes

How Detroit Homeowners May Finally Rid Themselves Of Tax Foreclosure Outlier Media

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Can I Sell My House With A Tax Lien We Buy Houses Nationwide Usa Cash For Houses Ugly Homebuyers Near Me

Past Due Delinquent Property Tax Loans In Virginia Home Savers